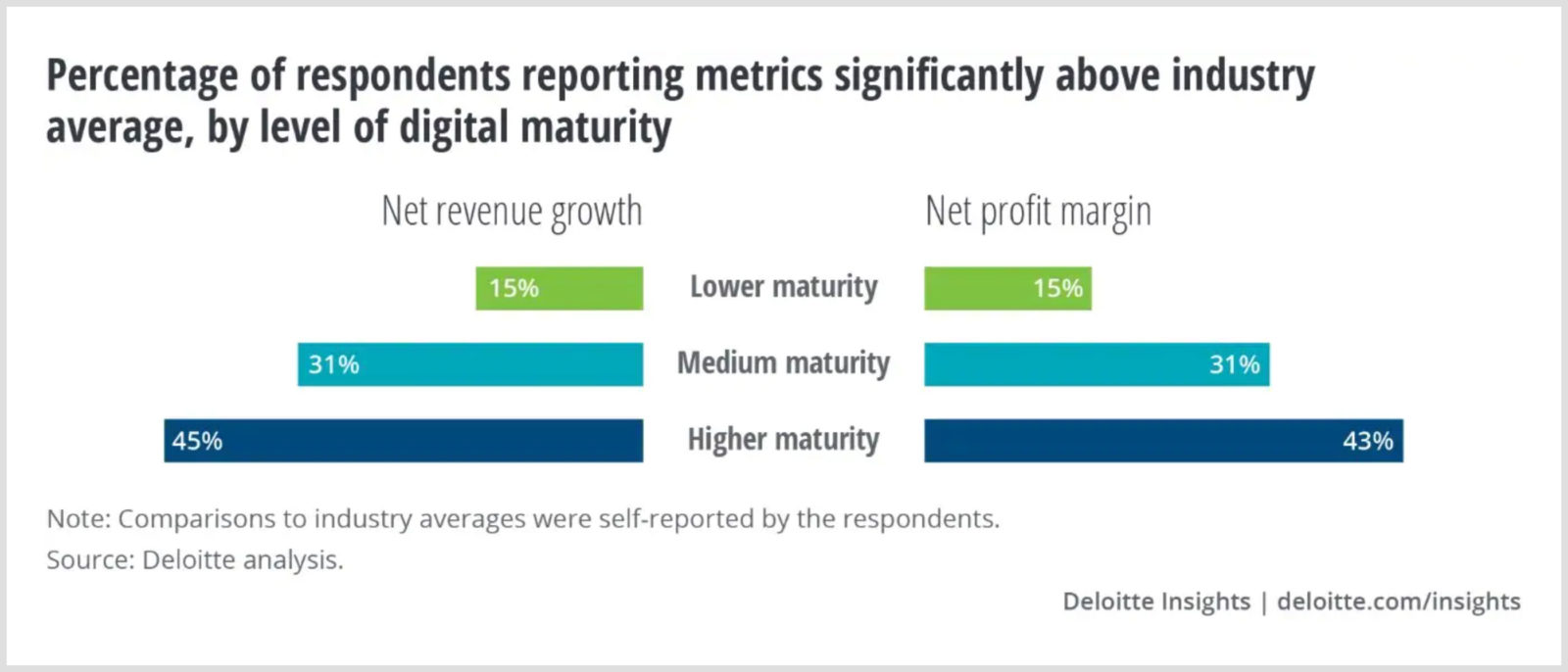

Data has the power to create incremental portfolio value – in fact, data-driven, digitally-mature companies achieve ~30% higher net profit margins and net revenue margins than those with low digital maturity. Yet, despite the clear connection between digital businesses and financial performance, 67% of executives are not comfortable accessing or using data from their existing tools and resources, ultimately letting their most valuable asset go to waste.

At our recent webinar with Waypoint Consulting, Data-Driven Value Creation: Key Levers Of Success For Private Equity Firms, participants learned how to maximize their firm’s portfolio growth opportunities by harnessing the power of data analytics.

Missed the live webinar?

Watch it on-demand and unleash the power of data analytics in your portfolio.

1. Data analytics leads to smarter–more efficient–decision making

Building a data-driven culture allows Private Equity firms to have a holistic view of an organization that goes beyond checks and balances. It helps businesses plan more strategically, which improves the accuracy and outcomes of decision-making by providing the ‘why’ behind what’s happening – or the driver behind various correlations and trends – vs. only the ‘what’.

Without a holistic view, businesses are left with an incomplete picture of data that can lead to decisions made on gut instinct, rather than concrete numbers.

These sentiments ring especially true for Private Equity firms working to create portfolio value. Now, more than ever, firms need to value and treat data as an asset to more accurately forecast change, pivot and innovate quickly, and create an outsized advantage to stay ahead in an increasingly competitive and unpredictable environment.

2. Data drives digital transformation and enterprise value

While data analytics was considered a nice-to-have in the pre-pandemic era, today, it’s no longer a choice – having a data analytics strategy in place is now required to drive business operations as well as digital transformation and enterprise value.

According to Gartner, “Data and analytics are the key accelerants of an organization’s digitization and transformation efforts. Yet today, fewer than 50% of documented corporate strategies mention data and analytics as fundamental components for delivering enterprise value.”

As industry leaders continue to “wield data and analytics as competitive weapons,” Gartner also predicts that, by 2022, “90% of corporate strategies will explicitly mention information as a critical enterprise asset and analytics as an essential competency.” Data is no longer just a tool to drive business decisions, it’s also quickly becoming an asset that drives market leadership and – ultimately — enterprise value.

3. Data analytics lead to value creation and value realization

The direct benefits that can be realized from data include maximized ROI, increased revenue, operational efficiencies, and a decrease in operational expenses.

Image source: Deloitte

Image source: Deloitte

For example, firms can start by using data to manage enterprise and business performance, which has a direct impact on driving value and creating an understanding of where portfolio companies can reduce costs.

In addition, data can help realize value by:

- Generating a 360° view of the customer, enabling customized product and service offerings.

- Increasing productivity through the efficiency of the existing value chain and support systems.

And importantly – as mentioned before – data serves as a lever for revenue generation: according to a study conducted by Forrester, data-savvy companies are 58% more likely to surpass revenue goals.

Find out how your firm can use data to drive value creation, via a private data analytics workshop, complementary to Private Equity firms and their portfolio companies.